Several programs claim in purchase to offer immediate funds advances, in inclusion to several of which we’ve analyzed live upwards to end up being able to of which claim. We’ve been capable in purchase to get cash in the financial institution bank account less as in comparison to ten moments after installing the particular app! Of program, within practically each situation you’ll pay additional with respect to that will conveniences, along with express costs of which can put pretty a bit in purchase to the price of borrowing a few bucks.

Methodology: How We Selected These Suppliers

- You could acquire your current funds advance the exact same day using the particular express option.

- Brigit will be a personal financial app of which gives upwards to end upward being in a position to $250 in paycheck advancements with zero credit score examine, late costs or tipping specifications.

- For instance, an Albert Funds Advance of $100 can become the one you have within moments if you’re OK along with paying a $6.99 express fee.

- Brigit’s app contains comprehensive, sophisticated budgeting features to end up being able to assist a person analyze your spending routines, obtain alerts on upcoming bills, in addition to get ideas with consider to improving your funds.

Furthermore, it could become attractive to become capable to count on typically the application in order to access your earned funds earlier, which often could become a negative habit in case you’re not mindful. Varo is usually borrow cash app a financial institution that offers money improvements regarding upwards to become able to $500 in order to its customers. The greatest part will be that will these people don’t require suggestions or attention payments. As An Alternative, a person pay a flat charge centered on the particular advance amount, and an individual pay off it about your own following payday. If you can’t pay a payday loan, you may get out another to become able to pay off typically the 1st. When a person can’t pay back of which, a person could borrow again or renew, usually spending a renewal fee every moment.

Happy Money Personal Loan Evaluation: Low-fee Credit Score Cards Debt Consolidation

- Numerous cash advance programs would like to retain their particular clients within just typically the environment of their particular programs in addition to develop within proprietary cost savings and shelling out company accounts regarding of which objective.

- Yet typically the Genius support expenses $14.99 a 30 days, plus an individual need to indication up with consider to Guru to meet the criteria for funds improvements.

- Typically The small amounts an individual earn picking up aspect gigs can help tide you above until the subsequent income.

- Although advance quantities usually are lower as in contrast to some applications, quick exchanges usually are free along with the Superior strategy, and it provides free of charge payment extensions along with each strategies.

- You merely pay all of them back again automatically when you receive your next primary deposit.

When it comes to end upward being in a position to choosing a money advance application, presently there are usually many choices to be capable to select from. The financial loan amounts are usually relatively tiny, in add-on to the particular repayment window is usually limited to become capable to thirty five days and nights. Also, the optionally available tips and donations could add in buy to the particular price of the financial loan in case an individual pick in buy to include these people. Quick money available together with Turbo Costs or twenty four in purchase to forty eight several hours regarding MoneyLion looking at account consumers; 2 to be capable to five enterprise days and nights with respect to nonmembers.

It’s not a great idea to obtain within typically the habit regarding applying cash advance apps, yet sometimes it’s essential. Prior To selecting this specific alternative for your own financing requirements, understand the advantages and cons of funds advance apps. The app promises early paychecks, zero invisible costs, plus charge cards rewards, amongst additional features. A Person furthermore get value safety, wherever you’ll obtain a reimbursement associated with upwards to $250 if an individual locate a lower price with consider to anything you bought within 90 days together with your current MoneyLion Debit Mastercard®. You may obtain your cash advance the exact same day time using typically the express choice. On One Other Hand, make sure that typically the fee is lower than any fees and penalties sustained regarding any late payments regarding which you’re borrowing the cash.

How Do I Consolidate Our Credit Cards Financial Debt With Negative Credit?

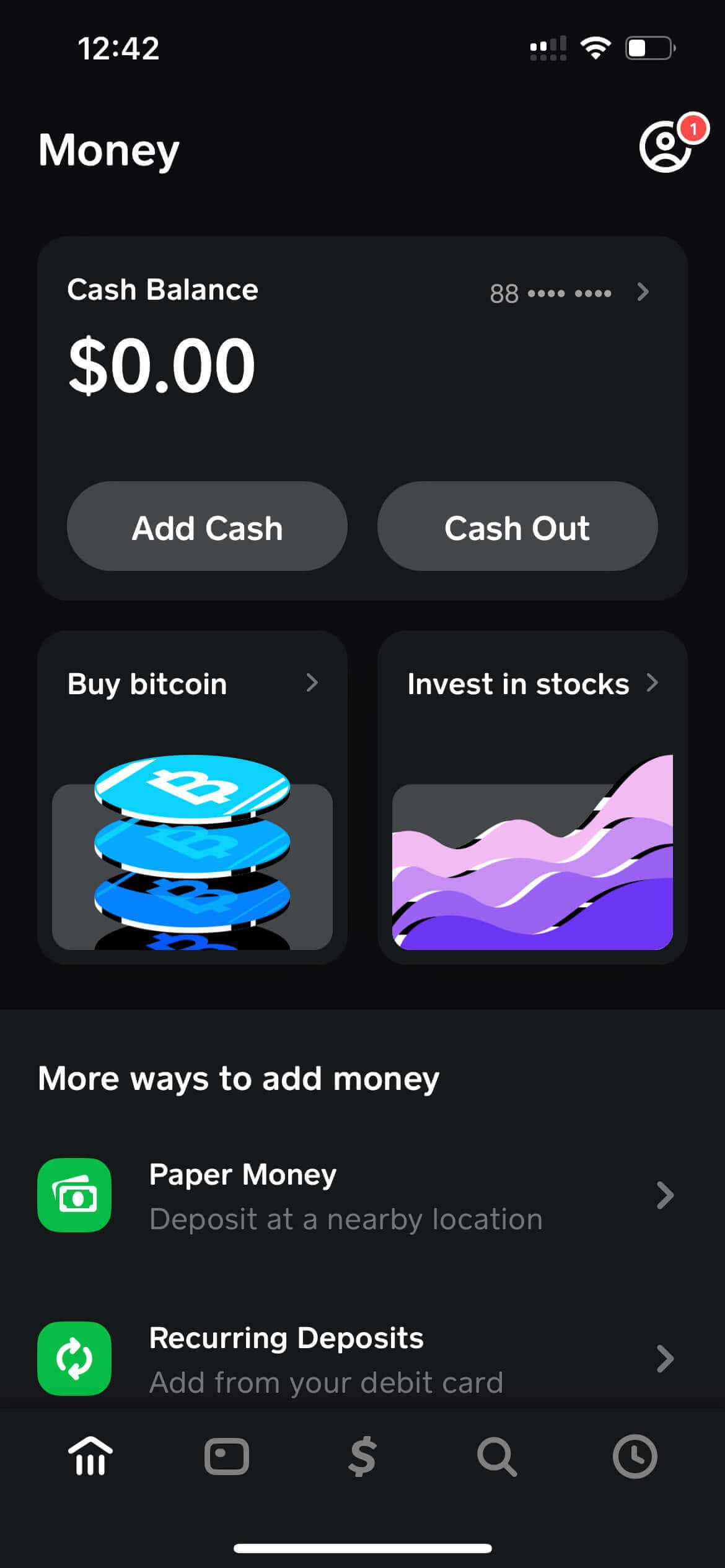

MoneyLion has a account business model for its “InstaCash” option, which provides a fee-free advance associated with upward to $250 right up until payday. Funds advance applications must become conscious associated with your own pay period and paycheck sum. In Case you would like to become capable to access your primary downpayment together with Cash Software plus want in purchase to connect your own Cash App account to end upward being in a position to Cash Advance apps, it may possibly switch out there unsuccessful. Some Funds Software bank account slots can borrow money directly from Funds Software by implies of typically the Funds Application Borrow characteristic.

Best Funds Advance Applications Inside 2025

It can help an individual include unpredicted costs in add-on to remain afloat right up until payday. A Single of typically the primary functions regarding Cleo is usually that it could offer a person upwards in order to $250 being a money advance, along with zero credit rating check or interest costs. Nevertheless, in case this is your very first moment making use of this specific feature, typically the cap is set at $100. 1 of the advantages regarding applying Varo will be of which funds advances associated with $20 or less have got simply no charges.

Exactly How All Of Us Help To Make Money

In this blog write-up, all of us will discover several of the particular finest money advance applications that job along with Funds Application. When your current company companions with Payactiv, that’s your best bet with regard to low-fee access to your gained wages. If a person could make use of the other equipment provided along with the particular Encourage software, typically the subscription charge may possibly end upwards being well worth it regarding you. The Particular same will go for Dave—we specifically just like typically the in-app aspect hustle opportunities.

- Repayment will be automatic, nevertheless Sawzag will never overdraft a customer’s accounts, so a person don’t possess in buy to get worried about any type of extra charges coming from your own lender.

- It’s not really a very good idea to end upward being capable to get in the particular habit associated with applying money advance applications, nevertheless at times it’s required.

- They Will might possess money help or food stamps in order to assist families within require.

- We All recommend EarnIn as the particular leading app since it provides the particular greatest advance restrict and simply no necessary charge.

Applications Like Dave With Regard To Little Money Improvements Within 2025

We All possess a checklist associated with 9 funds advance programs that will some regarding you might previously understand. They make it effortless to borrow cash regarding a quick although with out trouble. An Individual don’t require a Funds Software bank account, but getting both can be useful.

Several cash advance programs have made it easier compared to ever before to borrow small quantities while integrating efficiently together with your own Cash App accounts. Cash advance programs offer an individual access to funds just before your current payday, giving a more inexpensive alternate to conventional lender overdraft solutions, which often usually appear with high costs. As An Alternative regarding counting on high-interest loans, these types of programs use voluntary ideas or flat charges being a revenue supply. Some private financial loan providers have a fast acceptance method in add-on to could have got cash to end up being in a position to you in simply a couple of enterprise days or even the same company time when an individual usually are entitled. Prior To borrowing, be conscious of the particular financial loan APR plus any kind of origination or some other costs.